Buying Home Equity

There are a million things to love about being a homeowner. The freedom and the comfort of owning your own space is what everyone’s dream is built on. Buying a home sooner rather than later can be very beneficial. This is because a home allows you to build equity. And the sooner you begin, the sooner you’ll start building equity. When you make a mortgage payment each month, you build equity in a place of your own. (Unlike a rent payment which goes entirely to your landlord).

At Agent ReVa, we help you understand all aspects of the home buying process and make it easier for you to choose.

Building equity is certainly one of the main benefits of homeownership. The key thing about equity is that you don’t notice it while it’s happening, but at some point, you’ve got a valuable asset that can be used for almost anything. It sounds great, doesn’t it? But, firstly let’s understand a bit more about equity.

What is Equity?

The word equity comes from the word “Equality”. In investment terms, we call it Equity share. “A share means a Portion of something” So basically, Home equity is a value of the ownership of property.

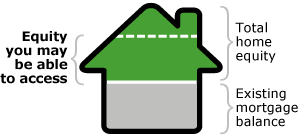

In simpler terms, Equity is the amount of your home that you actually own. If you borrowed money to buy your home, you can calculate your equity by subtracting your loan balance from the value of your home.

For example: Let’s say your home is worth $750,000 and you owe $200,000 on your mortgage. $750,000 minus $200,000 equals $550,000 of equity in your home. This is the value of the property that you “technically” own. This is the value you can do something with if you sold the home.

When can the home be yours?

It seems like a no-brainer — that if you have the cash available to pay off your mortgage loan early, you should do it.

The sooner you pay it off, the sooner the home is yours. You would own 100% of your home equity.

You no longer have to pay interest every month…

You can proudly call your home “Yours”

When your loan is paid in full, you can rest easy knowing you do not have any more obligations to the bank

So let’s look at a practical example

Example 1- You buy a beautiful home for $500,000, your down payment towards the home is $25,000 which is 20% of the total value. So currently your home equity is 20%. Your fixed mortgage term is 5 years with an interest of 3.49%, Bi-weekly payments with an amortization period of 15 years.

In this scenario, your payment will be $1557 bi-weekly. And in as little as just 15 years, you can fully own your home!

The minimum down payment as per the rule is 5% of the total value of houses below $500grand but for all down payments below 20% of the total value of the house, insurance is essential.

You can make your mortgage work for you and make sure you own your home in just a few years.

This is where ReVa can help you. (Click here) to get your own Ultimate guide for homeowners

ABSOLUTELY FREE. No catch or hidden fee!

Also, for all your financial queries just Ask ReVa! The AI empowered Real Estate Virtual Assistant who is armed with every bit of knowledge you seek in the entire home buying process. Click here to Just Ask ReVa.