What can you do with Equity?

You might wonder what you get out of all that equity and why its raved about. The short answer is that it’s an asset that you can trade for any monetary transaction. Of course, There are benefits to paying off your loan early, the first, and most substantial, is you will pay less interest over the term of the loan. These savings can often be very significant. The second is the psychological benefit of not having a mortgage payment every month — owning your home outright.

But, Not everyone would feel the same sense of relief at having paid off his or her monthly mortgage for good and they have a good reason to feeling the same. Especially the younger generation who like their financial flexibility and liquidity.

If you want to own a home but still have a financial liquidity and not have all your money locked up, this is an option you can consider.

To pay-off or not to pay-off?

“Ask yourself — would you rather have no money in the bank and no mortgage, or have money in the bank and have a mortgage?”

There is no right or wrong answer. Some people don’t like to have any debt, but having liquidity is important too.

The major drawbacks to paying off a loan early would include

- losing the mortgage interest tax deduction

- the inability to use the money elsewhere.

As the equity in your home grows, your financial flexibility also increases. Think of it as an extra source of financing for when the unexpected happens.

Home equity can be a nice foundation for wealth building. If you ever need cash, you can borrow against the equity in your home with a second mortgage (also known as a “home equity loan”)

An added benefit of borrowing money against the equity in your home is that it usually comes with a lower interest rate than other forms of credit, such as consumer loans, lines of credit and credit cards.

Here are some ways you can use the home equity loan:

- Pay off other debts with higher interest rates (like credit card debt)

- Renovate or repair your home – build a new room or put in a swimming pool

- For important life events – a wedding, dream vacation or university tuition

- Emergencies – like a serious illness.

How to Build or increase your Equity

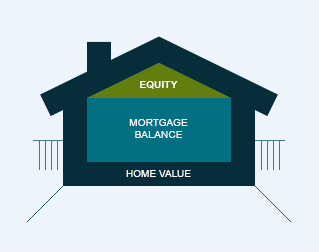

Now that we have figured out that building equity is extremely beneficial in a number of ways, let’s look at options to build our equity. There are generally two ways in which your equity can be increased,

- The property value increases

- The amount of debt decreases

Let’s briefly see how we can work this out,

The property value increase

When the value of the property increases, your mortgage doesn’t. This means that the equity of the home automatically increases. This is one of the main reasons for the increase in home equity. As the real estate market keeps on rising, so does the cost of your home and ultimately, your equity.

Some of the ways by which this is possible are

- Natural increase based on demand

- Maintenance and upkeep

- Value additions and home improvement

This is one way you can increase your equity. Let’s look at the next

The amount of debt decreases

Your ultimate aim is to decrease your debt and pay it off or keep it to a minimum. If the value of your debt decreases, naturally, your equity builds. This can be accomplished by

- Making regular monthly payments

- Getting a shorter loan term

- Making extra payments when possible

- Not opting for a second mortgage.

Shorter-term loans build home equity (in terms of principal reduction) at a faster rate but require higher monthly payments. Payments for a 15-year fixed-rate mortgage can be more than 40 percent higher than for a 30-year fixed-rate mortgage.

In retrospect, higher payments may make mortgages less affordable or limit access for lower-income borrowers. For example, higher payments may result in a higher debt-to-income ratio for some home buyers, which may prevent them from qualifying for a mortgage unless they buy a less expensive home. So the homeowner has to have an optimal loan term based on a lot of key factors.

This is where ReVa comes to the rescue. Click here to get your own Ultimate guide for homeowners ABSOLUTELY FREE and for all your financial queries on home equity Just Ask ReVa!